Are you tired of living paycheck to paycheck and not sure if you will be able to pay your bills?

Are you not sure where your paychecks are going each month?

We have designed an easy to use tool that will allow you to be able to track your finances and be able to keep on top of what you are spending. We like using this tool because it is customizable to your lifestyle.

Many people who start a budget like to use strictly cash, but this will work with people with multiple credit cards as well.

Before we jump into how it works, we have another tool that we have created that will help you figure out what you are allowed to spend in a given month to hit your budgeting goals. Check out our Proactive Budgeting Calculator to see how much money you get to actually spend each month. Basically, the calculator asks how much money you would like to put into savings over a 12 month period, and figures out how much spending money you get each month to make that a reality! Its easy to use and will give you a better idea whether you are doing well at budgeting or not according to your goals.

Here are the steps that you need to make it work.

- Pick a day of the week that you would like to plug in your expenses. This will be critical in making sure it is completed each week. Me and my wife like to do ours on Tuesday nights as that is when we have the most available time.

- If you are using credit cards, get on your online portals and look at the last transactions of the last week. We will need these to plug into our report. If you are using cash, pull out all your receipts for the last week.

- Go to the ‘Expense Log’ tab of the spreadsheet. This is where we will enter all of our expenses.

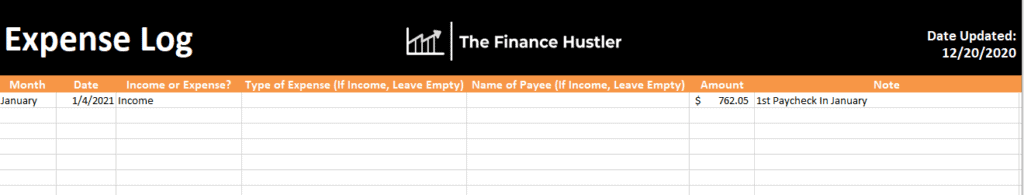

- First enter any paychecks that you may have gotten. Enter your pay of what you earned after taxes. Fill in all columns except the ones it says to leave empty for income. Below is an example of what it should look like filled in.

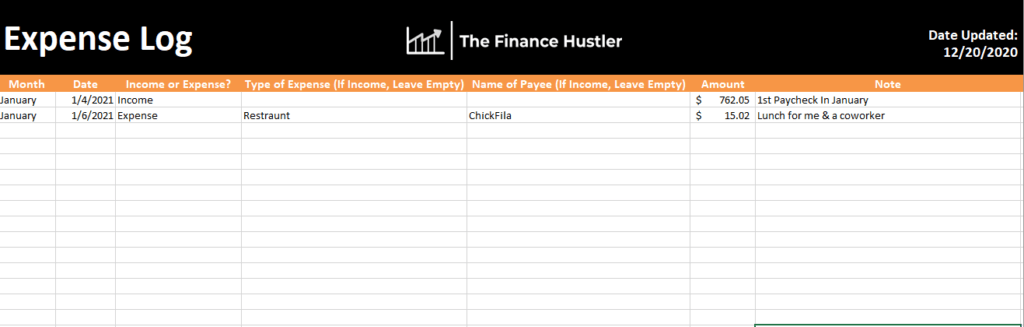

- Fill in all of your expenses. Fill in Month, Date, Income or Expense, Type of Expense, Name of Payee, Amount & note if applicable.

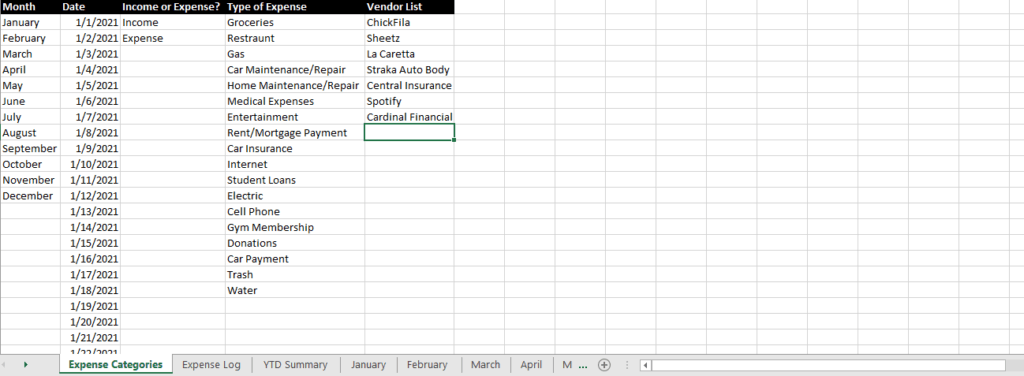

- For type of expense, & name of payee you can add new categories that you use on the “Expense Categories” tab so that they appear on the dropdowns of the ‘Expense Log’ tab.

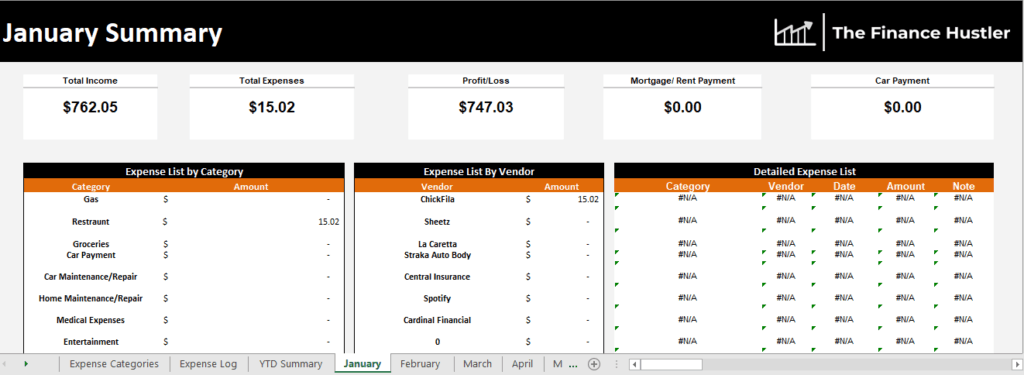

- Once you fill in your Income & Expenses, you will be able to see it populate in the month tab that you are entering your receipts on. This will help guide you with what companies & categories you may be spending the most money on and make adjustments that will help you be successful. I know that eating out is something that I struggle with so “Restaurants” is the field that I will pay the closest attention to.

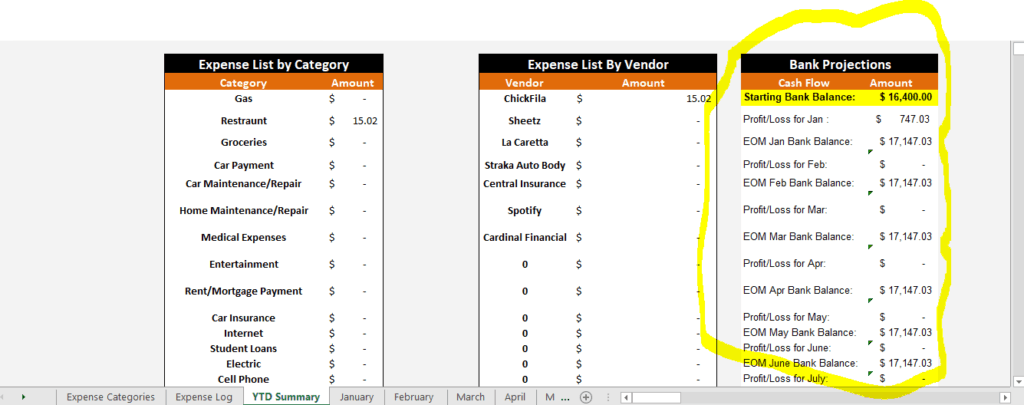

- The YTD summary will allow you to see how you are doing on the year with your expenses. There is Also a built in Bank Account Projection on the YTD summary. To make this work for you, simply enter your bank account balance in the highlighted section on the tab, and the spreadsheet will do the rest as you enter in expenses.