In just over a year, I was able to pay off over $30,000 in debt! This included some student loan debt that I still had to pay off as well as my car loan. Through many different trials and test runs I finally figured out what I needed to do in order to gain financial freedom from my debt.

First you need to figure out how much you want to save this year. Is it $10,000? $20,000 or $30,000? Maybe you are saving up for the car of your dreams, buying your first house, or working your way towards financial freedom. Get that dollar amount in your mind so that we can help make you smart at budgeting.

Once you have come up with that number, write it down somewhere you will always see it. I don’t care if it is a reminder on your phone, a sticky note in your car or a note on the fridge. This number is what is going to guide you for all your future decisions so put it in a place you wont lose it and help you become smart at budgeting. When you want to ride by Starbucks before you go to work and get a $5 coffee you will see this note and remember the end goal that you have set for yourself.

We are all used to a certain way of living. We get to the point where it becomes the expectation for us to have certain things, look a certain way to others, and create an appearance that we have it all together. The funny thing about that way of living is that it actually is preventing us from reaching our end goals. The only ones that truly stop us from reaching our goals is ourselves. In order to make your financial goals attainable, you need to make a concerted effort to put you and your families above everything else.

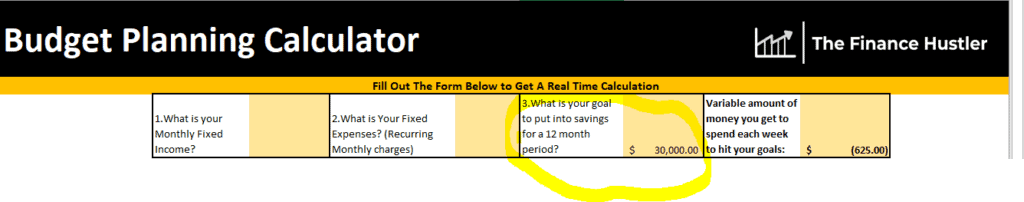

Step 1: Filling in your Savings Goal on our Proactive Budgeting Calculator:

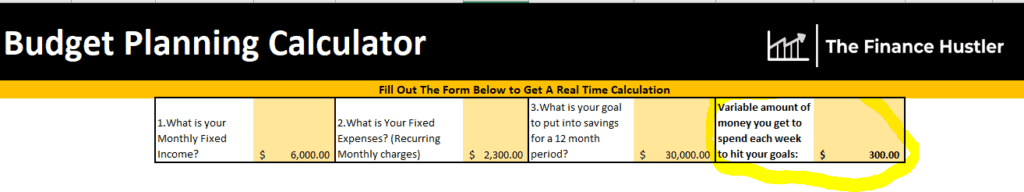

We will start with that number that you recently just wrote down. Keep it close as we are going to be plugging it into our Proactive Budgeting Calculator. (Click on this link to take you to the download). This will help us figure out the spending money we will be allowed to use each week and help us become smart at budgeting. Once you download the tool and have it open, fill in the amount of money you are looking to save for the year. We have chosen $30,000 for the year in the below screenshot. This can be adjusted later in this post if you determine that it is unrealistic.

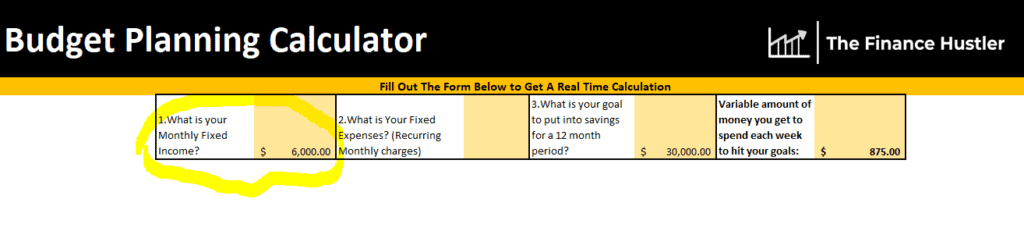

Step 2: Filling in your Monthly Income:

Once you have filled in the number, we will look at filling in the next part which is what your fixed monthly income is. Its time to take your paystubs out and do a little math. If me and my wife were doing this and we made $1500 together each week (after taxes) we would put that our fixed monthly income was $6000 since would normally get 4 paychecks per month.

If you are someone who does not have a consistent paycheck and earns commission, go off what the minimum amount you would get paid. For instance, if your commission each month ranges from $1,500 to $3,000 to month, use $1,500 as your fixed income.

Now its your turn! Once you have down the math and have your fixed monthly income fill it into the blank below.

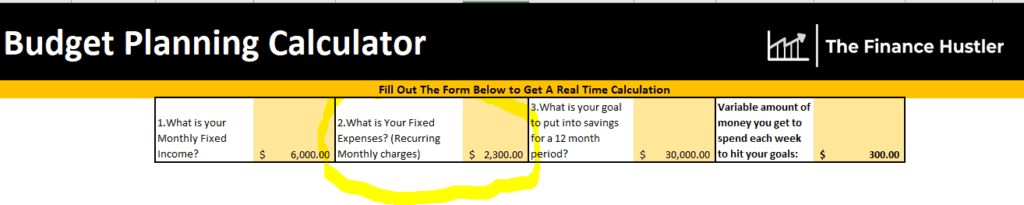

Step 3: Figuring Out your Fixed Monthly Expenses:

Great Job! Now we are on to the final and most difficult portion of this calculator. Figuring out what your fixed monthly expenses are. These are any expenses that stay the same each month that we pay our bills and are not going to change. For our example, we will say that our Mortgage is $1400 a month and fixed at that price. We also have an $150 a month Electric bill, $70 a month for internet, $150 for phone service, $100 for Cable, $200 Car Payment, $200 Car insurance and a $30 water bill. Once you add all those numbers up, you come to a total of $2300. Here is a list of fixed expenses to give you an idea for on your smart budgeting spreadsheet:

- Mortgage/ Rent

- Utilities

- Cable

- Phone Bill

- Internet

- Insurance

- Car Payment

- Debt Payment (Student Loan, Personal Loan, Etc.)

- Subscriptions (Hulu, Netflix, Spotify)

- Memberships (Gym, Clubs, etc.)

Once you have calculated all your fixed monthly expenses, fill it into the blank below.

Step 4: Figuring out our Weekly Spending Budget:

You have finished filling it out and can see what your monthly spending money will be! The Below Screenshot highlights the number that will be each week.

You will have to look at that number and determine whether that is a realistic goal for you or not. $300 a week equals out to $1200 a month that me and my wife would have to spend on food, gas, entertainment, etc. I would say that this is a stretch goal and a little unrealistic, but we may determine that it is doable for us.

The best way to tell if it is attainable is by figuring out is by making it a daily amount of money we can spend. If we get $300 a week, then dividing that by 2 people (me and my wife) we would both get $150 a week. Dividing that by 7 would give us about $21 a day which is not very much per person.

Some of you may not even have enough spending money to make the goal you set a possibility. Maybe there are some fixed expenses that you could cut back on to make that goal more attainable. Others may have to look at finding a Side Hustle to generate extra side income to make it happen. (The link above is our guide to starting a Side Hustle)

If you are willing to put in the extra work, we can help you realize your goal even if it may seem out of reach. Do not set an unrealistic goal though and get discouraged when you are not able to reach it. Set something that can be attainable and makes sense for you.

Step 5: Get Smart with tracking Your Expenses on our Budgeting Sheet. Submit Your Email Below and we will send you a Free Copy!

Now that we have a goal in mind, we can now start to keep track whether or not we are hitting our goals. We can do this through The Finance Hustler Budgeting Template. Our budgeting spreadsheet will give you more insight than any other tool out there. You will be able to determine what businesses you spend the most money at, and what expense categories are struggle areas and you can improve on. Below we have laid out a step by step process on making it work.

Here are the steps that you need to make it work.

- Pick a day of the week that you would like to plug in your expenses. This will be critical in making sure it is completed each week. Me and my wife like to do ours on Tuesday nights as that is when we have the most available time. It will keep you accountable to the weekly goal you set for yourself and let you know where you can improve. In order to become smart with budgeting, setting time aside each week is critical to hitting your goals.

- If you are using credit cards, get on your online portals and look at the last transactions of the last week. We will need these to plug into our report. If you are using cash, pull out all your receipts for the last week.

- Go to the ‘Expense Log’ tab of the spreadsheet. This is where we will enter all of our expenses.

- First enter any paychecks that you may have gotten. Enter your pay of what you earned after taxes. Fill in all columns except the ones it says to leave empty for income. Below is an example of what it should look like filled in.

- Fill in all of your expenses. Fill in Month, Date, Income or Expense, Type of Expense, Name of Payee, Amount & note if applicable.

- For type of expense, & name of payee you can add new categories that you use on the “Expense Categories” tab so that they appear on the dropdowns of the ‘Expense Log’ tab.

- Once you fill in your Income & Expenses, you will be able to see it populate in the month tab that you are entering your receipts on. This will help guide you with what companies & categories you may be spending the most money on and make adjustments that will help you be successful. I know that eating out is something that I struggle with so “Restaurants” is the field that I will pay the closest attention to.

- The YTD summary will allow you to see how you are doing on the year with your expenses. There is Also a built in Bank Account Projection on the YTD summary. To make this work for you, simply enter your bank account balance in the highlighted section on the tab, and the spreadsheet will do the rest as you enter in expenses. This is the most exciting part because you will be able to tell how much money you are adding each month. It will also give you that extra push to make your budget a possibility.

Great Job! You have made it through this post and have started your own smart budgeting spreadsheet! The keys to success are going to be making sure you stay on top of it and setting time aside each week to enter your expenses. Second, we need to not be discouraged when there are weeks where we are not hitting our goals. Unforeseen life events happen and can through what we thought would be a good week into a bad one. If this happens, continue to stay on top of it and make adjustments in your spending so that you can make your dreams into a reality.

Once you are able to start saving money, consider to look at investing your money into something. Check out our article on How to Start Investing to help you get started. We recommend that you try to put at least 10% of your income into some sort of investment.

Still struggling to hit your Savings Goals? Here are Some Smart Budgeting Tips that will help you make your goals happen

- Food Expenses– Eating out is one of my biggest struggles that prevents me from hitting my financial goals. Be sure to keep close track of what you are spending because food costs add up. I realized one month that our food costs added up to $1200 in one month! Switching out some brands you usually would buy for value brands when you are getting groceries is a big help as well to check into next time you go shopping

- Subscriptions– Budgets are helpful for tracking our monthly subscriptions. You may even realize you are spending more money on something than we realized. Another thing you can do is make substitutions for cheaper options. An example would be eliminating your cable for Sling TV or something similar.

- Start a Side Hustle– A Side Hustle can be a gamechanger for you. Earning extra Side Income is what could be gets you over the top. It doesn’t mean you need a second job either. There are plenty of part time “businesses” you could start such as lawn mowing, blogging, etc.

- Spend Carefully on Big Purchases– Buying a House, Car , New Laptop, or renovation can be an exciting time. Unfortunately, its easy to get caught up in the bells and whistles of some of the biggest purchase items that we make a financial mistake by buying something we really can’t afford. The problem is once we commit, it is hard to go back on some of these type of purchases and we are stuck for years trying to pay off large amounts of money that we don’t really have. Don’t be that guy and do your due diligence in making sure you will have enough extra cash flow after your purchase to live off of.

- Follow other bloggers with helpful budgeting tips– The Busy Budgeter, Dave Ramsey, & The College Investor offer great advice for different age groups on how budgeting is applicable to them. Give them a follow for additional budgeting resources to help you be successful.