Are you nervous about making the biggest purchase of your life?

I know me and my wife were. We bought our home in May of 2020 just when all of the chaos of COVID was taking place. The housing market was hot and it seemed like properties were selling before they were even listed.

We were trying to figure out if we should wait because of an upcoming housing market crash that could possibly happen because of the pandemic. We ultimately decided to go ahead and get our first house and it has been quite a journey.

Before we bought our home, we looked at 30-40 houses. It seemed like nothing was really what we were looking for. We finally found a home that we both liked, and it was listed 4 hours when we went and looked at it. The problem? There was already 8 offers on it.

We decided to go ahead and make an offer on it. While our realtor was drawing up the paperwork, my wife was looking on Zillow and saw another house that came on the market. It was really overgrown and needed A LOT of work, but it was in a great neighborhood where we knew we would like to be. (Below is a Picture of what it looked like)

We asked our Realtor if he could show us this new listing and we fell in LOVE with the location. The house was in need of a lot of updating, (Obviously) but we felt like we would get a great return on our property.

We did not make an offer on the other house, and decided to make it on this house instead.

By the time we signed the contract, we had earned over $15,000 in Equity before even putting money into it! We did this by using these 5 tips that will help you in your home buying experience to make sure you are getting the best possible deal on your first home.

Tips to Get a Great Deal on Your First House

Tip #1- Checking Comparables in the Same Neighborhood

Checking House Comparables is very important when you are looking to buy your first home. Its VERY EASY to do now with Zillow.

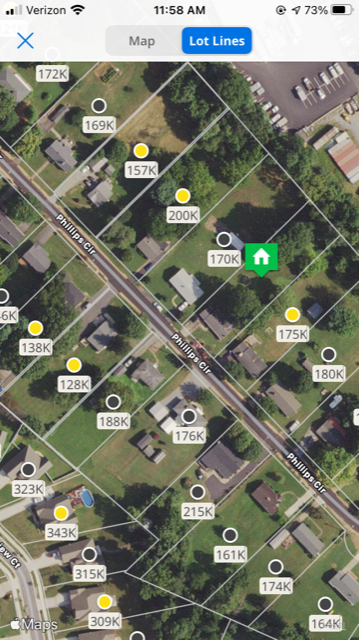

If you use the app like me, you simply go to the listing you are looking at, and go one of the last pictures which is a map. (It should look like the picture below)

Click on the Map and there should be an option to press for “Lot Lines”. Press on that and you can see the values of homes that have sold around it. (The sold homes are the ones that are yellow, red are currently listed, and gray are not on the market)

Using this Scenario above, Is the house worth investing into at $130,000?

If the house is listed for $130,000 in this scenario, it may be worth looking into as a potential investment opportunity. There are other factors to obviously consider which are size of house, size of lot, & condition that will all play a part in the home’s value.

If you find one that is very similar to your house in the same neighborhood, that will give you an idea on the true value of your home. You can click on the yellow dots and it will pull up any recently sold house with pictures that you can use to compare.

Tip #2- Check your area for any potential foreclosures & short sales

Foreclosures & short sales are great ways to get good deals on properties. When a bank takes back a property from someone who fails to pay their mortgage, they typically just want to cut their losses and sell the property as quick as possible.

This can provide great buying opportunities if you can make a quick decision. To find foreclosures in your area on Zillow, simply filter the “Listing Type” to just Foreclosures and you will be able to see what is available in your area.

When COVID hit, the government would not allow Foreclosure listings because they did not want them driving down the value of anyone trying to list their property. Some areas are allowing them again so check your city and see if that is an option for you.

Tip #3- Figure Up How Much Money you Would Need to go into Renovations

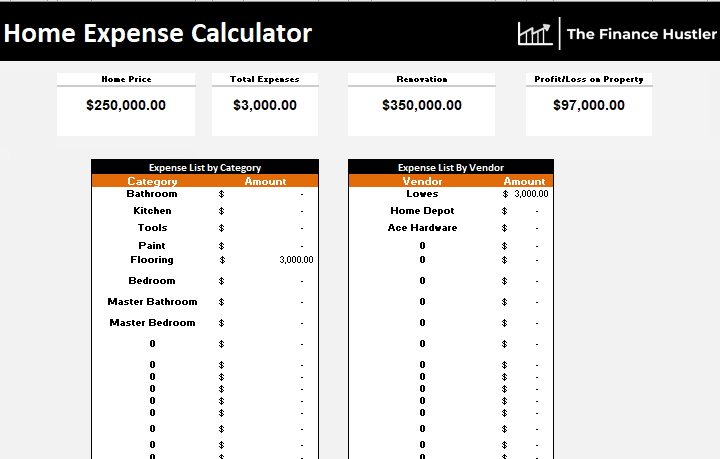

Home Expense Calculator

Put your information below to get a Free Download of my calculator!

DO NOT miss this step! Renovations can be very costly depending on what you need done to your home. Use our Calculator above to help you figure out if the house is worth investing in. Don’t worry we will send directions on how to use it as well.

The most common costly expenses are the Roof (Expect $5,000-10,000), Windows (Expect $5,000), Kitchen ($15000-30000) & Heat source. If your house is in really bad condition watch for Plumbing, Electrical and Foundation issues as well.

One thing to remember too is that renovations usually end up being MORE than what you figure up. Typically in the process of updating, you find problems you are not aware of. Houses that need work are never as easy as you see on HGTV.

The Ideal house would be one that simply needs the cosmetics. If you can find something that needs painted, new flooring (Vinyl Plank is really Easy), and other small adjustments, you can really change the value of your home. Below is our house just after cleaning up the Landscaping and mulching.

Tip#4- Get A Home Inspection to Make Sure You Know of Any Costly Problems

Not always will you walk into a house and see everything that is wrong with a house. Getting a home inspection can help alleviate some of that. They will go through your house and let you know of any potential issues they discovered.

It is a few hundred dollars to get one, but they are worth every penny. If you are under contract on a home and the inspection finds a big issue, you can get out of the contract before you close. Don’t focus on the costs of getting one done, but instead of the potential headaches you will alleviate.

Tip#5- Dont Be Afraid of A House That Needs Sweat Equity

Like a said before, remodeling a house IS NOT like what you see on HGTV. It is a lot of hard work and can take months before you are actually done. If you are not afraid of rolling up your sleeves and hard work though, then this should be something you definitely consider.

Many people will be scared off when they see all the work that needs done. This will help eliminate some of your competition for great deals! Look for houses that look unattractive because of poor pictures, and cosmetic issues that you know you can easily resolve.

I was able to do some renovations to my home and achieved 20% equity from putting in the work! It is an easy way to increase your home’s value without having to invest a ton of money into it by hiring a contractor.

Do you feel as if you don’t have the knowledge to do a home renovation?

Use Youtube as a guide on projects around the house. There are videos that can show you step by step what you need to be able to in order to get the job done.

Home Expense Calculator

Put your information below to get a Free Download of my calculator!